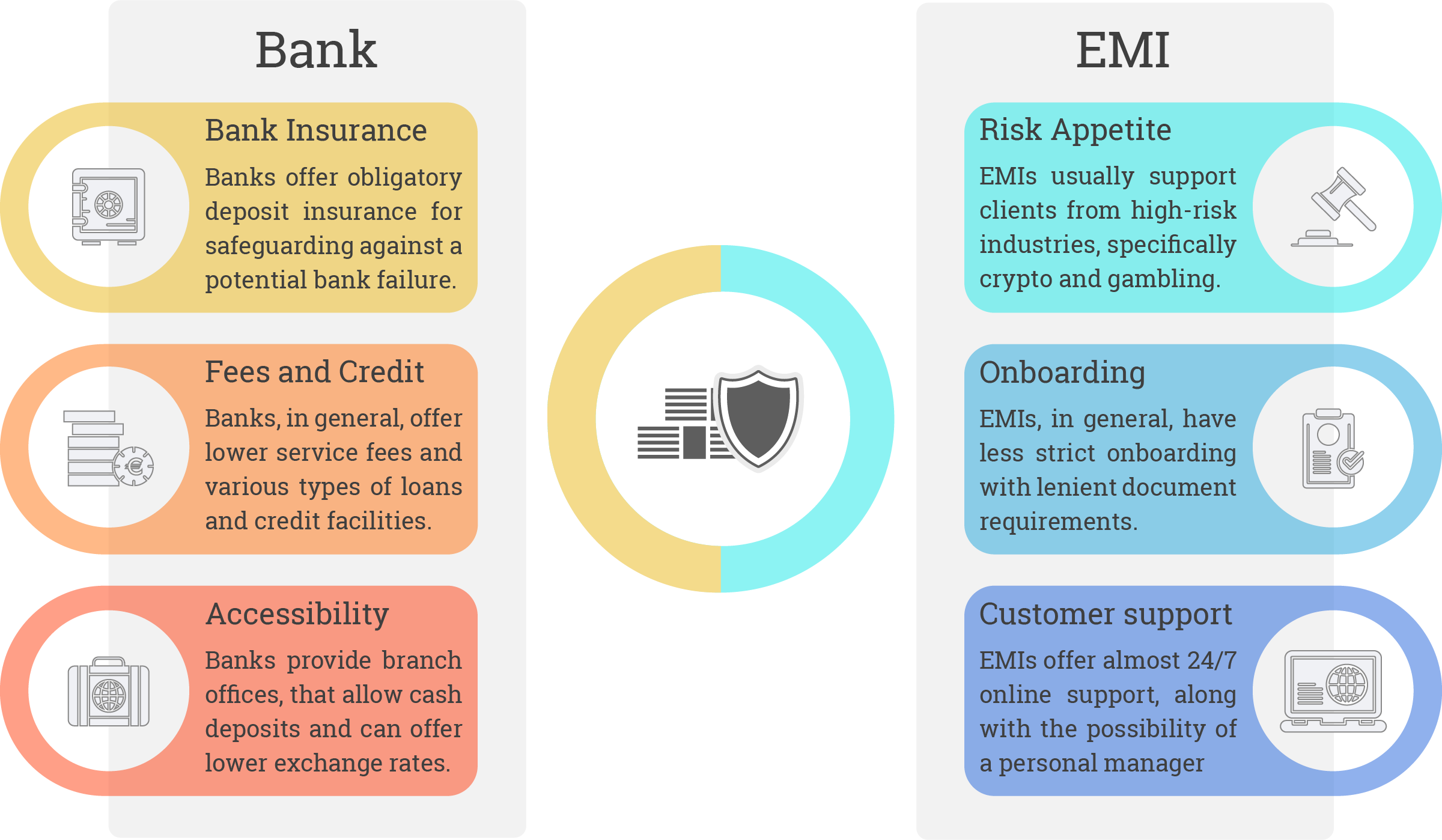

EMI in the EU stands for Electronic Money Institution, a regulated financial entity operating under the Payment Services Directive (PSD) or its updated version, PSD2. As a regulated institution, it provides electronic money services, allowing customers to store funds digitally and conduct electronic transactions.

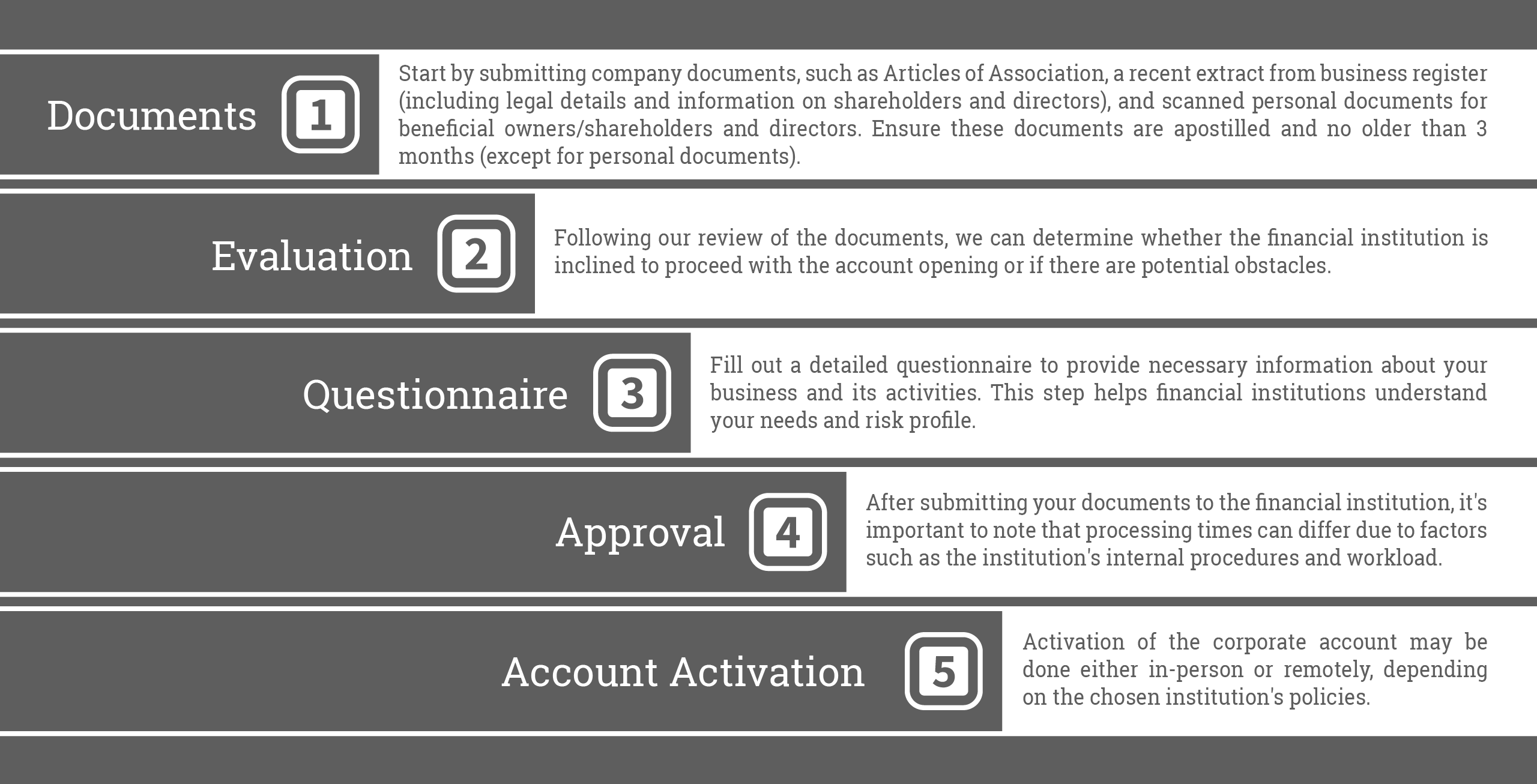

Discover the step-by-step process of opening a bank account in the EU with our expert guidance. Our team at Stronghold Consulting works closely with various banks and financial institutions, ensuring a seamless corporate account opening experience.

Document requirements for opening a bank account or EMI vary based on the chosen institution, jurisdiction, and business activity. Factors such as internal policies, risk assessment, and regulatory guidelines can influence the needed documentation.